Zimbabwean Real Estate Will Take Time To Recover

The real estate of Zimbabwe might stay under the influence of the Covid-19 epidemic much longer than expected. As per the analysts, Commercial as well as residential occupants, are being affected by the pandemic wave. The extensive impact of global lockdown has pushed the sub-merged economy further into the deep sea as commerce was already struggling due to the instability of the economy and fluctuation in control rates.

According to Christabel, Shava property vending has shrunk as the personals and businesses support confining measures similarly, and execution of present and future contracts rests unknown. The proprietors are facing a decrease in the flow of cash and the detention of occupants. Still, in the medium to long run, property owners must report decreased rental levels as the ZNCC, i.e., The National Chamber of Commerce – Zimbabwe, asked for a descending review of tenants.

The engagement is required to negotiate the rentals in the mutual interest of both parties. The proprietors are requested for a descending review of tenants to around 50% in the second half of 2020. But the dialogue must apply to commercial arrangements only, as per the representative of the business body.

The financial pressure of the pandemic has already affected the businesses that ultimately upshots the employees. The property firms of the region were facing scarcity so far even before the Covid-19 outbreak.

The government has declared the installment policy for Commercial as well as residential tenants, which are due for April with the addition of suspension eviction during the period of lockdown.

Interpreters at Akribos Research Services indicated a hopeful prospect by mentioning the suspension of extended lockdown this Sunday. In the first phase of the economic report, analysts said that the country would continue to starve for a while as the economic condition decreases with the decrease in occupancy levels and incomes.

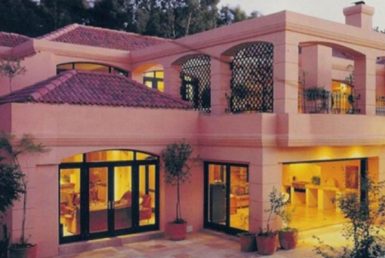

Zimbabwe’s infrastructure demands high residential properties, approximately 1 to 3 million units of national housing backlogs. Harare city needs over Five hundred thousand houses to cater to the demand of the population.

According to the interpreter, investments in the sector of real estate fluctuate heavily in calamity. Due to the broad drift over time, the increased area is needed for the medium to long term.