Hope on Sub-Saharan Countries Economic Growth In 2018

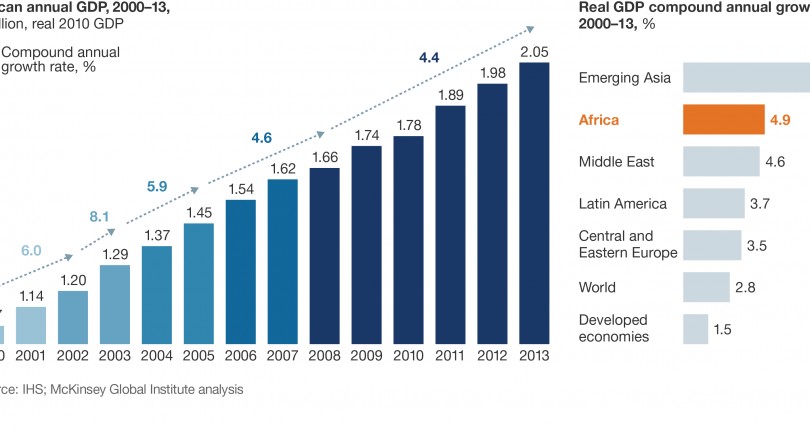

Investors have something to give them hope on the journey to 2018. A report released by the International Monetary Fund (IMF) on sub-Saharan countries says that the economy is expected to grow from 2.6% in 2017 to 3.4% in 2018. The growth is lower than the previous years where it was noted that between 2004 and 2011 there was a growth of 6.2% but with a significant increase realized in 2007 which was 7.6%. A global financial crisis was witnessed in 2008 that lead to the negative deviation of 4.1%.

An average growth of 4.5% was realized between 2012 and 2015, but that has grown down since 2015. One-third of the sub-Saharan countries will grow by 5% or more, and this will cover most of the eastern and western African nations. This will be per the average per capita income in 12 countries that are believed to have 40% of the region’s population according to the IMF report which states the figures to be at 400 million people.

The IMF looks at those countries that offer the best growth opportunities in 2018 with significant challenges in 2019. The 2019 problems are expected to be brought about by economic and political instability created by elections in some countries in two years or more.

Most investors are expecting a growth of 1.9% and 1.1% in Nigeria and South Africa respectively despite the elections in 2019, making some investors worried.

Cote d’Ivoire

The growth of 7% and above has always been realized in the past few years, and it is expected to maintain in 2018 and 2019. The extension is connected to the fact that there is an improvement in power generation, increasing interest from the private investors and development institutions, modern equipped airport, strong road network and at the same time it’s the home of West Africa second largest port.

There is an increasing demand for the housing and office space to accommodate the growing middle class and international business in the country. However, the small-sized investors should also be accommodated.

Senegal

The reliable energy and transport infrastructure are playing a vital role in taking the growth to 7% by 2018.basic infrastructure have always provided the best basement for the economic growth in Senegal. Small and medium enterprises (SMEs) have not been neglected as in other African countries.

President Macky Sall’s regime has emphasized on supporting entrepreneurship in industrialization, manufacturing, and agriculture to boost the SMEs. Therefore, the government has raised confidence in the investors despite the elections in 2019.

Ghana

The right approach to the economic growth by Nana Akufo-Addo’s regime excited the investors. After his election in 2016, it took him time to streamline on his plans this gave his mixed reviews in 2017. However, there are strong indications of a growth of 8.9% in 2018. There is an expectation of an increase in oil production to be at par with the $60 on Brent price. Agri-business plans to resume drilling on Ghana’s TEN projects in early 2018 are some of the encouragements to the investors. Education is a priority as far as its reputation in West Africa’s education is concerned.

Ethiopia

The growth of the number of consumers, increase in consumer’s expenditure and trial and proving of investments will give the investors a ready market hence aiming at a growth of 8.5% in 2018. The high demand for non-food related goods requires more investment to reach the consumer’s need.

Burkina Faso, Kenya, and Mozambique

Burkina Faso is expected to realize a growth of 6.5% in 2018 from 6.4% growth in 2017. The government believes in allocating money to the right investments for the increase to be realized.

Kenya is on the verge of doing away with its presidential elections. The earlier the elections are settled, the better for the investors who see Kenya as the East Africa economic giant. With the best airline in the region, it stands at the best point to attract more investors.

Mozambique is regaining its stature after settling its substantial international debts. President Filipe Nyusi is doing the best he can to give the country the right image. The country’s growth revolves around gas production, agri-business, logistics and warehousing and this has been given a more significant boost after the last two or so years.

Zimbabwe poses a unique picture given its political stands and the systems of the ruling which has forced investors out of the country. A lot has to be done on the investment rules, and laws to change the investors view on the land.